What We Offer

We are offering financial services in terms of issuing microcredit loans to the people with less earning in the underprivileged areas and motivating them to become self-employed, who want to raise their income in a self-sufficient manner.

Our Products:

Micro Enterprise Credit Program:

This program supports small enterprises, which have been set up by the people, mostly in their homes, settlements and villages.

Credit facilities are being provided for different professional categories across Pakistan through 42 different locations. During this past decade credit provided under this program amounts to more than PKR 7 Billion. This disbursement is 70.3% to male and 29.7% to female enterprises.

Total borrowers accounted for in the portfolio is 392,974 individuals. The exposure involved ranged from Rs. 15,000 to Rs. 80,000 with markup of 0.54 paisa per thousand per day to 0.98 paisa per thousand per day.

The security involved is personal guarantee with an undated cheque. The loan is given after due verification by the Credit Officer of the respective area. Any person who has previously defaulted is not provided with any sort of financial credit facility.

The company along with other different professional sectors has proudly served 34% Trading and 21% Manufacturing sector contributing significantly to the communities’ financial and social uplift and ultimately to the national economy.

Micro Enterprise Credit Program:

This program supports small enterprises, which have been set up by the people, mostly in their homes, settlements and villages.

Credit facilities are being provided for different professional categories across Pakistan through 42 different locations. During this past decade credit provided under this program amounts to more than PKR 7 Billion. This disbursement is 70.3% to male and 29.7% to female enterprises.

Total borrowers accounted for in the portfolio is 392,974 individuals. The exposure involved ranged from Rs. 15,000 to Rs. 80,000 with markup of 0.54 paisa per thousand per day to 0.98 paisa per thousand per day.

The security involved is personal guarantee with an undated cheque. The loan is given after due verification by the Credit Officer of the respective area. Any person who has previously defaulted is not provided with any sort of financial credit facility.

The company along with other different professional sectors has proudly served 34% Trading and 21% Manufacturing sector contributing significantly to the communities’ financial and social uplift and ultimately to the national economy.

Interest Free Loan:

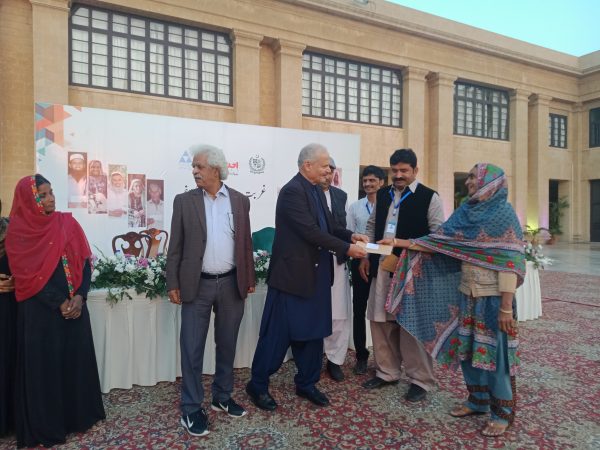

We are working with Prime Minister Ehsaas Interest Free Loan program launched in our branches under the supervision of PPAF where we facilitate our products in the Enterprise, Livestock and Agriculture sector.

In past OPRCT has availed proceeds from Prime Minister Interest Free Loan through PPAF even though the proceeds were returned to PPAF but the portfolio which had been generated by the organization continued with us and we continue to revolve it.

Also in the recent past Misereor has extended cash grants for its utilization by the organization in the manner it deemed fit. We also used that grant to extend our interest free portfolio.

Both funds are being utilized in revolving funds which were created for interest free loans to small business owners. Activities are mainly carried out in Sindh and more that 10,000 borrowers have been provided benefit from it.

The exposure involved is ranged from Rs. 15,000 to Rs. 50,000 with average per borrower limit of Rs. 17,000. The security involved is personal guarantee with an undated cheque. The loan is given after due verification by the Credit Officer of the respective area.

This table is showing regular loan programs in detail description, period, service charges and loan size in the Enterprise, Livestock and Agriculture sector.

Interest Free Loan:

We are working with Prime Minister Ehsaas Interest Free Loan program launched in our branches under the supervision of PPAF where we facilitate our products in the Enterprise, Livestock and Agriculture sector.

In past OPRCT has availed proceeds from Prime Minister Interest Free Loan through PPAF even though the proceeds were returned to PPAF but the portfolio which had been generated by the organization continued with us and we continue to revolve it.

Also in the recent past Misereor has extended cash grants for its utilization by the organization in the manner it deemed fit. We also used that grant to extend our interest free portfolio.

Both funds are being utilized in revolving funds which were created for interest free loans to small business owners. Activities are mainly carried out in Sindh and more that 10,000 borrowers have been provided benefit from it.

The exposure involved is ranged from Rs. 15,000 to Rs. 50,000 with average per borrower limit of Rs. 17,000. The security involved is personal guarantee with an undated cheque. The loan is given after due verification by the Credit Officer of the respective area.

This table is showing regular loan programs in detail description, period, service charges and loan size in the Enterprise, Livestock and Agriculture sector.

| Product | Enterprise |

|---|---|

| Description | Small Scale Regular Loan for Urban and Rural Areas for Manufacturing and Service sector |

| Period | One Year |

| Service Charges | 1.05/1000 balance decline basis |

| Loan Size | 15,000 to 80,000 |

| Product | Livestock |

|---|---|

| Description | Small scale Seasonal Loan for Rural Areas and Villages having Land not more than 12 Acres |

| Period | Six months |

| Service Charges | 0.54/1000 balance decline basis |

| Loan Size | 15,000 to 80,000 |

| Product | Agriculture |

|---|---|

| Description | Small scale Seasonal Loan for Rural Areas and Villages having Land not more than 12 Acres |

| Period | Six months and One Year |

| Service Charges | 0.54/1000 balance decline basis |

| Loan Size | 15,000 to 80,000 |

| Product | Description | Period | Service Charges | Loan Size |

|---|---|---|---|---|

| Enterprise | Small Scale Regular Loan for Urban and Rural Areas for Manufacturing and Service sector | One Year | 1.05/1000 balance decline basis | 15,000 to 80,000 |

| Livestock | Small scale Seasonal Loan for Rural Areas and Villages having Land not more than 12 Acres | Six months | 0.54/1000 balance decline basis | 15,000 to 80,000 |

| Agriculture | Small scale Seasonal Loan for Rural Areas and Villages having Land not more than 12 Acres | Six months and One Year | 0.54/1000 balance decline basis | 15,000 to 80,000 |